Tax Season Invest in Art

Tax Season Is Upon Us – What Does Art Have to Do With Taxes?

As tax season approaches, many Canadians are looking for ways to maximize deductions, invest wisely, and make strategic financial decisions for the year ahead. While traditional investments such as stocks, real estate, and RRSPs dominate financial discussions, original Canadian art is an often-overlooked asset that offers both cultural and financial value. Tax season is upon us, invest in original Art.

Art as an Investment

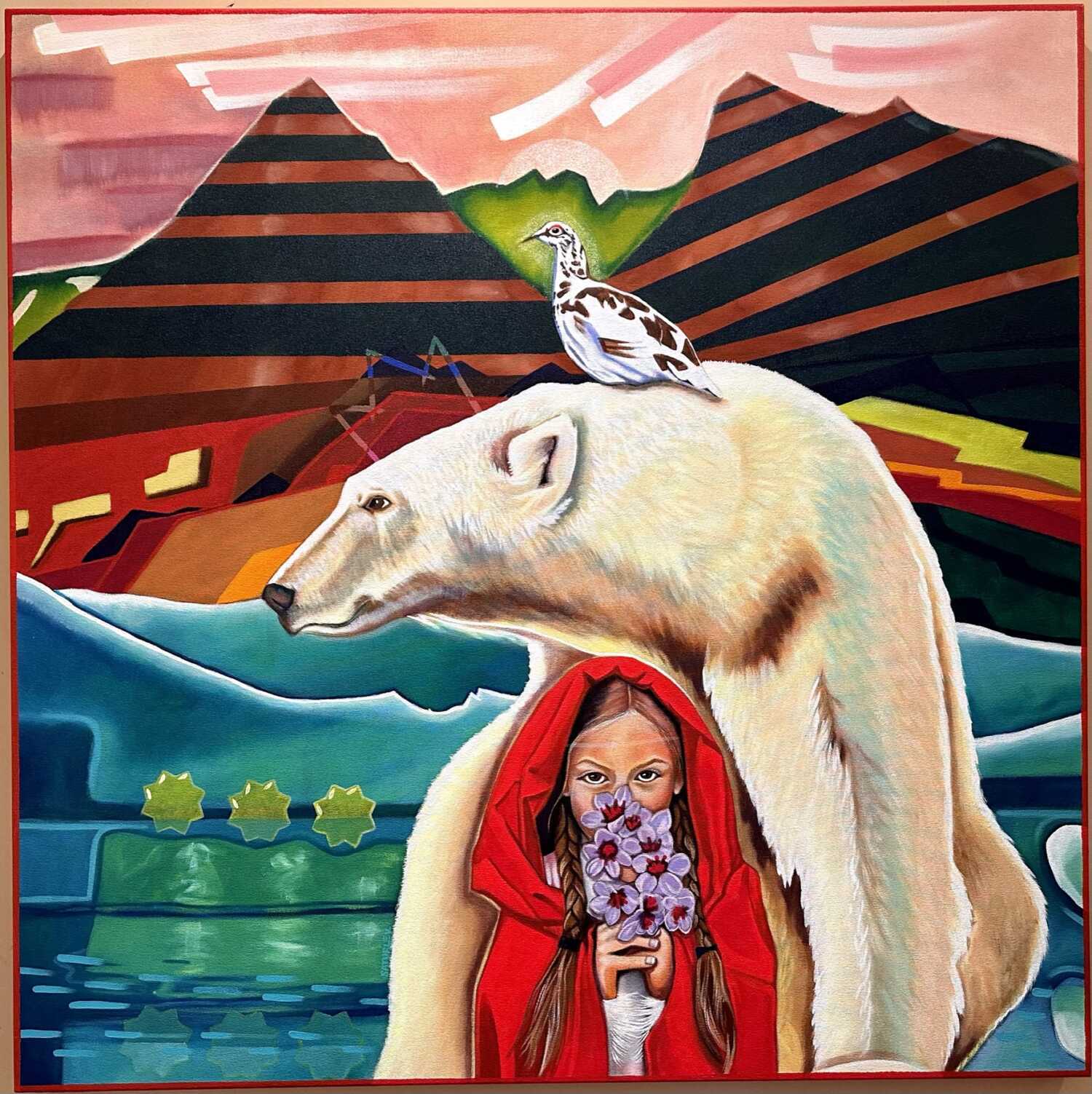

Investing in original Canadian art is not just about aesthetics; it can be a sound financial decision. Unlike mass-produced prints or decorative pieces, original artworks by established or emerging Canadian artists can appreciate over time, providing a unique and tangible asset that enhances both your financial portfolio and living space.

The Tax Advantages of Buying Art

For businesses and corporations, purchasing original Canadian art can provide tax incentives. Under Canada’s Income Tax Act, businesses can claim a Capital Cost Allowance (CCA) on qualifying artwork, allowing them to depreciate the cost of the artwork over time. To qualify:

- The artwork must be created by a Canadian artist.

- It must be valued at $200 or more.

- It should be displayed in a place of business where clients, employees, or the public can view it.

This means that investing in Canadian art can not only elevate your workspace but also offer potential tax relief.

Supporting Canadian Culture and Creativity

Beyond financial incentives, buying original Canadian art directly supports artists and the cultural economy. By investing in Canadian artwork, collectors and businesses contribute to the development of Canadian talent, helping artists continue their creative work and ensuring a thriving national art scene.

Tax Season Invest in Art: Diversifying Your Investment Portfolio

Unlike volatile markets, art provides a tangible, long-term asset that is not subject to daily fluctuations. Many investors diversify their portfolios with fine art as a hedge against inflation and economic downturns. Unlike stocks or mutual funds, art remains a unique and personal investment that can bring joy while also increasing in value.

Where to Start

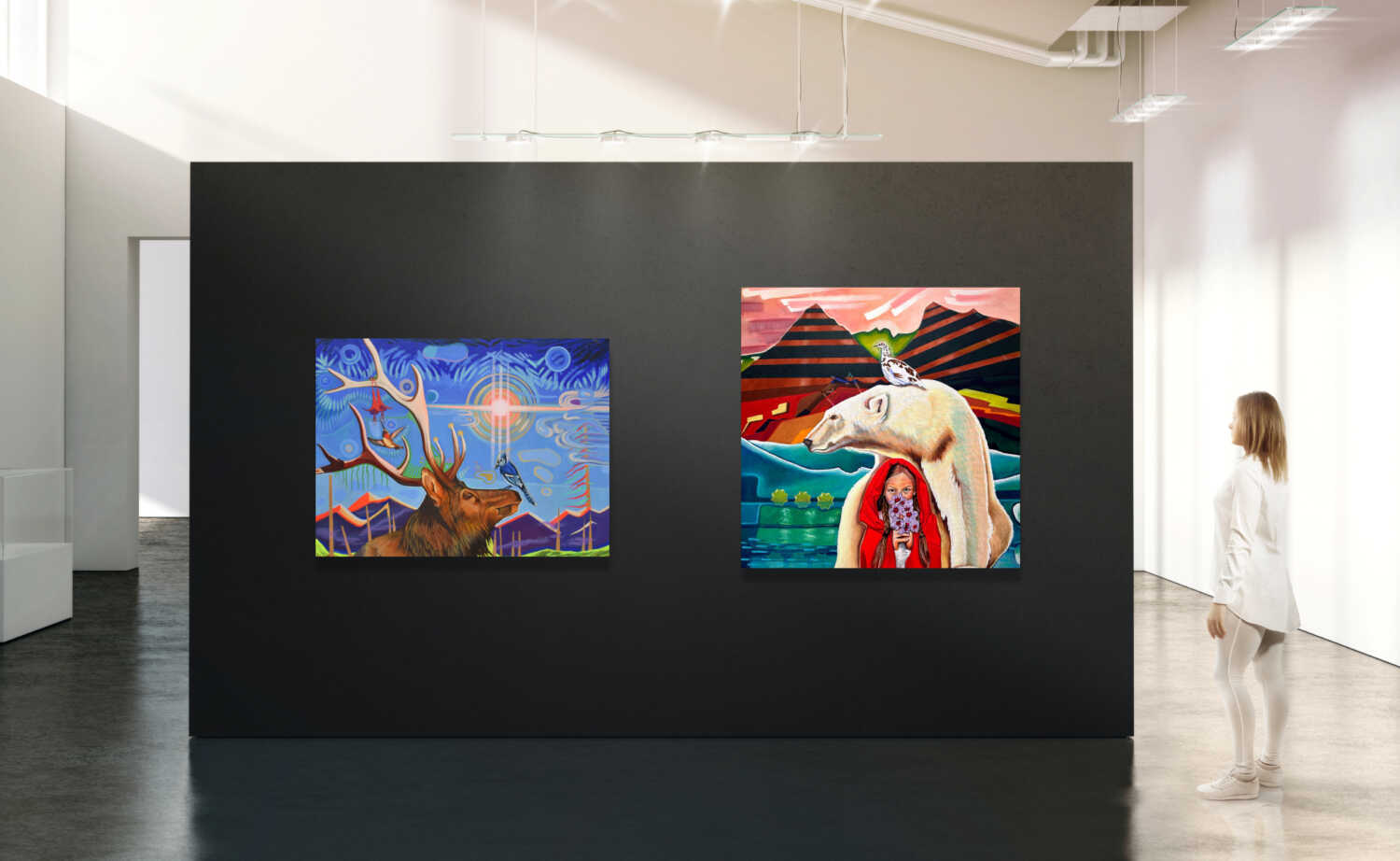

If you’re new to collecting, consider starting with artists whose work resonates with you. Research Canadian painters, sculptors, and mixed-media artists whose styles align with your interests. Galleries, online platforms, and artist studios are great places to explore available works. Many artists, including myself, offer direct sales, making it easier to invest in an original piece.

Tax Season Invest in Art: Final Thoughts

As tax season rolls in, consider the benefits of investing in original Canadian art. Not only does it provide financial and tax advantages for businesses, but it also enriches your environment and supports the arts. Whether you’re looking for a statement piece for your office or a long-term investment, Canadian art offers a unique way to grow your wealth while celebrating the vibrant creativity of our country.

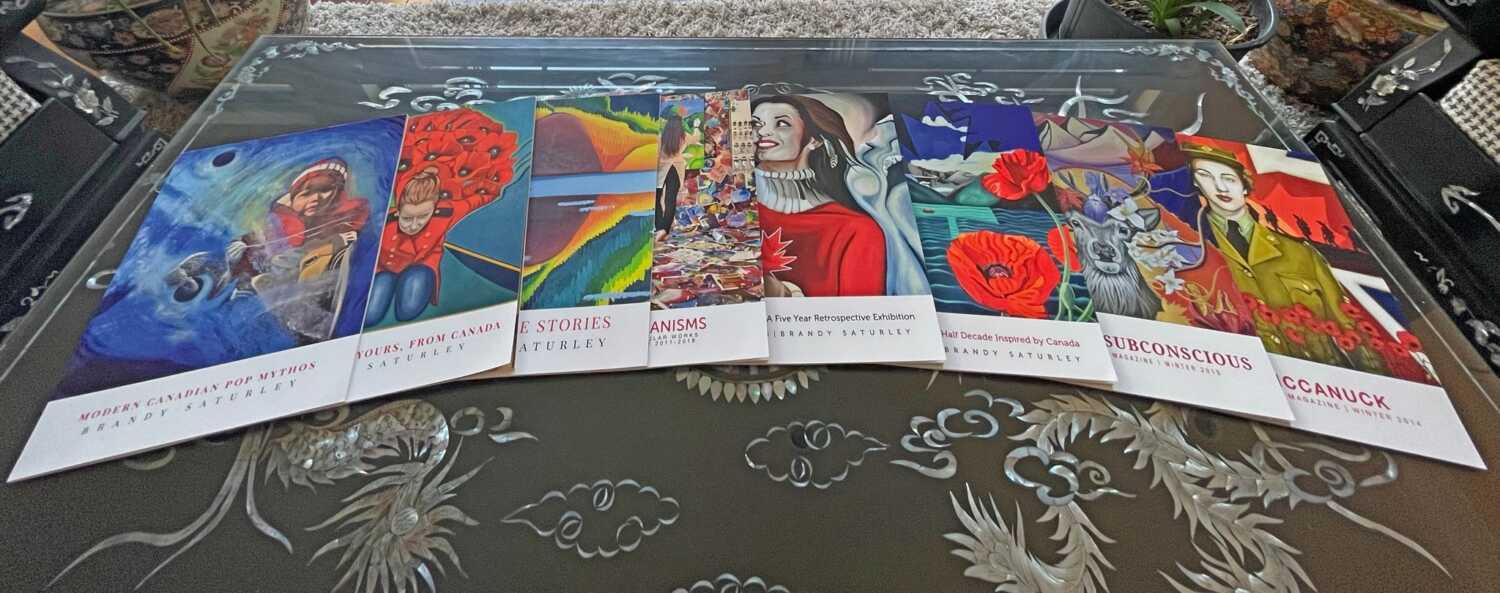

Explore the paintings of Brandy Saturley and start your art investment journey today!